Note that this is A STORY and not to be taken as a financial recommendation. I'm laughably unqualified for that.

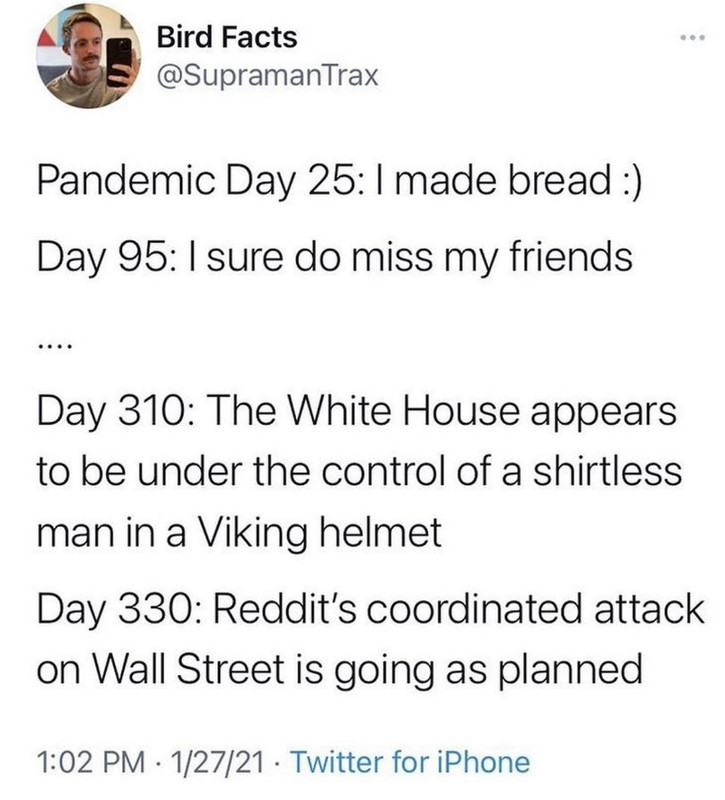

But this whole retail investor vs. hedge fund saga is fascinating to me.

For those who haven't been paying attention to this story, a notorious subreddit (a weird mix of financially savvy investors and memelords) noticed that GameStop (GME) was the most shorted stock on the market, and that the number of shorted positions actually exceeded the number of available stocks by 40-50%. So they started to buy GME, planning to hold it until those short contracts expire, thereby driving the stock price way up due to basic supply/demand. At that point, these hedge funds will either have to buy back their shares at a huge loss, or pay daily interest on every share held beyond the expiry date.

A poster on Bogleheads can explain the concept better than me, so I'll borrow their words:

Yesterday, CNBC was extraordinarily hostile towards this Reddit play, while ignoring that this has been standard operating procedure for these funds for decades. Brokerage platforms started to limit sales of GME and related stocks. Nasdaq's CEO warned that they might pause trading on certain stocks to allow overleveraged institutions to "recalibrate." All of these moves play into the big guy vs. little guy narrative here, and I find this absolutely fascinating.

Here's a good interview on CNBC from yesterday that underscores that dynamic.

But this whole retail investor vs. hedge fund saga is fascinating to me.

For those who haven't been paying attention to this story, a notorious subreddit (a weird mix of financially savvy investors and memelords) noticed that GameStop (GME) was the most shorted stock on the market, and that the number of shorted positions actually exceeded the number of available stocks by 40-50%. So they started to buy GME, planning to hold it until those short contracts expire, thereby driving the stock price way up due to basic supply/demand. At that point, these hedge funds will either have to buy back their shares at a huge loss, or pay daily interest on every share held beyond the expiry date.

A poster on Bogleheads can explain the concept better than me, so I'll borrow their words:

linkBasically, Melvin [a big hedge fund] borrowed shares of GME from someone (could be you, could be me- brokerages lend out shares in exchange for a small fee all the time), with a contract to return them. Typically shorts are reconciled overnight, but that might just mean that they put up more collateral if necessary and pay the small fee again, and sometimes they're for a longer period. They sold those shares to someone else, on the theory that GME's price is heading lower, and that they'll rebuy them at a lower price and then return them to the original holder. If the price does indeed go lower, Melvin pockets the difference between the price they sold at and the price they bought at, less the small fee they paid. That's why it's called "shorting"- you're using an investment strategy that works only for the short term, vs "going long"- investing for the long term.

What happened here, though, is that the price has gone up and up- possibly because redditors were buying in, possibly because other institutions were buying in. That means that Melvin either has to put up more collateral, or it has to buy the shares back at an increased valuation, because they have to return those shares to the original owners. The theoretical danger- more of a real danger in this case!- is that if normally, if you buy a stock and it goes to 0, you've only lost the money you put up originally. If you borrow the stock and sell it, with the requirement that you rebuy it, your losses could be theoretically infinite- if the price goes up 10x, you have to buy at 10x the original value, which means massive losses. And that's exactly what happened here.

Yesterday, CNBC was extraordinarily hostile towards this Reddit play, while ignoring that this has been standard operating procedure for these funds for decades. Brokerage platforms started to limit sales of GME and related stocks. Nasdaq's CEO warned that they might pause trading on certain stocks to allow overleveraged institutions to "recalibrate." All of these moves play into the big guy vs. little guy narrative here, and I find this absolutely fascinating.

Here's a good interview on CNBC from yesterday that underscores that dynamic.